Thoughts on Investing and Starting Up

One of the hardest parts about early-stage investing is that you never truly know how well your fund is performing prior to liquidity. Contrast that to trading stocks in the public markets: at the end of every day, you know the exact value of each of your positions. This knowledge can be more stressful or less stressful depending on your personality. But we get back to the same issue… even on a quarterly or yearly basis, it’s hard to know how an early-stage fund is performing.

The prevailing metric is TVPI (“Total Value to Paid-in” Capital). But this begs the question:

How do you mark your companies?

The standard method for early stage companies is to just mark up to the last preferred share price. The public market-based comps method would in theory be better, but applies much better to later stage companies who have the sort of metrics that are more easily comparable to a public company.

For example, a company with $100M of revenue, burning $20M per year and growing at 50% might trade at 10x forward revenue, which is pretty straightforward, and you could readily apply this same method to a company at ~$25M of revenue, burning $20M per year and growing 150% using a correlation analysis. But what about a company at $2M of revenue, burning $12M per year and growing at 400%? This method starts to break down quickly.

But even if you could use this method, while a company is private it as a capitalization stack of preferred stock. Preferred stock can have debt-like and other unique features that create large value discrepancies between Series D shares and Series A shares, for example. Many secondary funds are great at running the sort of analyses on liquidation preferences, cap stacks, ratchets, etc. that are needed to really understand the difference in value between a Series A share and Series D share or a common share. But with a relatively small capitalization stack, still just a couple of years into the game, marking companies is much more arbitrary than we would all like to believe.

We’ve got to remember that all of these methods are really just a proxy for understanding absolute value accretion. Venture is meant to be an uncorrelated asset class where the only thing that matters over long periods of time is value accretion driven by profitable growth (or at least the potential for it). And of course, getting lucky with a low interest rate exit market many years down the road.

Sustainable revenue growth is the only true signal of value accretion -

that is our Alpha in early-stage venture.

The result of all of this is that “valuation stories” tend to attract all the attention, acclaim and focus for early-stage investors (and their LPs and the media), rather than what really matters: sustainable revenue growth. (Note that very few funding announcements include revenue numbers and almost all of them include capital raised, and several of those include valuation information. Might it be because there is a big disconnect? I don’t buy the argument that it’s because they would be disclosing somehow valuable confidential information.)

There is an argument to be made that when a company gets “written-up,” that should be validation of the progress of the underlying business, and map to the absolute value accretion. One big problem: free market dynamics are not at play in venture. One single investor can write up a company big time - and they just may be right - but it certainly does not represent the market. Unlike the public markets, there is no mechanism to short stocks, which balances this out, so you still really don’t know if a markup means progress or just the perception of progress by one person or fund.

So now I’ll make my aggressive argument:

Lower valuations (within reason) are better for everyone until exit. Investors, Founders, Employees, Acquirers. (The only losers are journalists who don’t get to knight another unicorn for their useless market reports.)

Why?

Optionality increases and distribution of outcomes becomes more proportional for all parties.

As an early-stage investor pretty aligned with founders, we have to remember that write-ups look and feel good, but they may not actually be good for any of us.

Since 2013, I have invested in well over 100 startups. Having a front row seat to all of these stories has given me a real (often painfully earned) appreciation for modest valuations (relative to capital raised, of course).

I would like to argue that write-ups actually represent Beta (volatility) rather than Alpha in venture because of the preferred-stock dynamics. I’ll illustrate with an example:

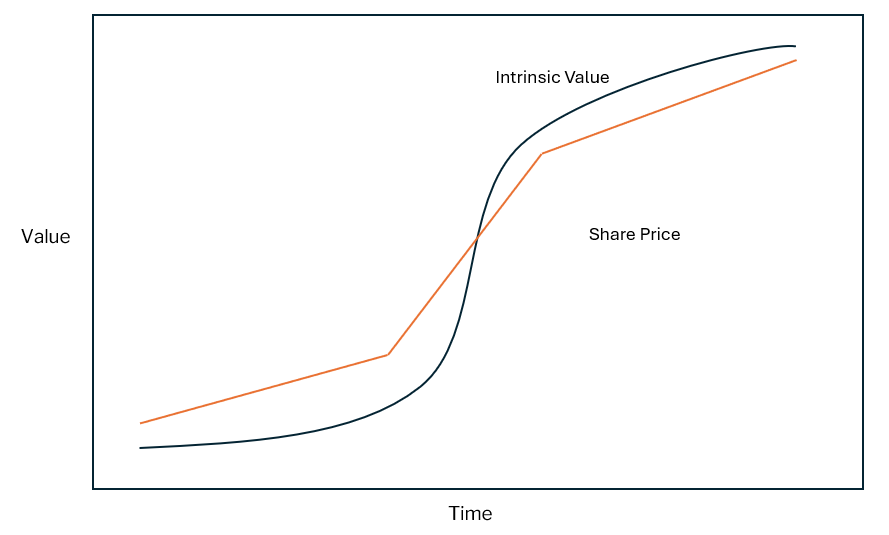

In this case, a company “gets hot,” and raises a big up-round: the founders feel rich, the early-stage VCs look smart - everyone is happy. But regardless of how well the business is doing, they might be looking at a long period of share price stagnation despite excellent progress due to market dynamics completely out of their control. (No responsible VC investor will look at a company that raised at $100M with $1M of revenue in 2022 and say “well now they’re at $5M, so it must be worth $500M now in 2025.”) In the above case, the company raised a down round at a lower share price - exactly what happens to founders, employees and early-stage investors is totally dependent on the details of the closing docs. It could be inconsequential or it could be a total wipeout.

Because of the preferred stock dynamics, share prices represent a hurdle more than anything. They are a mountain to climb, not one to stand on.

The consequence of not clearing this hurdle? See the middle 15 pages of your closing documents - it can be extensive, complicated and brutal. So even though you might be thinking, “well I’ll take the good market price now and deal with it later.” It is unfortunately not that simple and introduces cram-downs, recaps, ratchets, and other nasty down-round related terms which get buried in the docs.

The answer: the lower the hurdle, the lower the volatility, the more upside protection for all parties involved.

Everyone would do better if that same company had a share price trajectory that looked like this:

So we’ve got to remember that write-ups feel good in the moment, but immediately after closing, there is a new, very real hurdle to clear, often with dire consequences for missing it.

The worst thing in venture is not losing money on an investment, it’s losing money on an investment into a company that ends up being successful.

Events & Content

🎙 Podcast Feature: Tech on the Rocks

Tune in to Verissimo’s Nitay Joffe and Kostas Pardalis, founder of Typedef as they chat with tech geniuses on Tech on the Rocks—where hardware, cloud, and all things future-tech meet over a virtual drink!

January 2025 Episodes:

Episode 12: Building a Native Search Engine in PostgreSQL: ParadeDB's Journey to Replace Elasticsearch Featuring Philippe Noël

Episode 11: Optimizing SQL with LLMs: Building Verified AI Systems at Espresso AI Featuring Ben Learner

Portfolio Highlights

Aligned recently announced an $8M Series A round led by JAL Ventures. We were proud to be the first fund to back Aligned over three years ago, and have since watched them grow into a category-defining platform. We couldn’t be more excited about their trajectory and the tremendous potential ahead.

Aligned is a B2B customer collaboration platform designed to help sales teams boost transparency, reduce friction, and close deals faster. The platform offers a shared digital workspace where buyers and sellers can align on goals, track progress, and manage deal-related content seamlessly. Key features include Mutual Action Plans for structured deal execution, AI-driven insights to identify buying signals and optimize engagement, and smooth integrations with CRMs and sales tools. Additionally, the AI can autonomously engage with customers, answering queries and providing real-time support, enabling the sales process to continue seamlessly even when the sales team is unavailable.

Inigo provides complete visibility and control over production GraphQL APIs, empowering organizations to confidently adopt and scale GraphQL. Its essential tools include deep API analytics, schema-based role-based access control (RBAC), performance and error monitoring, dynamic rate limiting, and safeguards against schema breaking changes. Inigo delivers unique, in-depth insights into GraphQL usage, from field-level details and query paths to overall server health and performance. Its powerful engine enforces policies, blocks malicious queries before they reach GraphQL servers, and automatically identifies and resolves API issues.

NemoDATA is building an AI-powered predictive maintenance platform for vehicle fleets that analyzes sensor data to prevent failures. Seamlessly integrating with fleets’ existing telematics and data, NemoDATA’s proprietary virtual sensors help identify potential breakdowns before they happen, improving vehicle health, minimizing breakdowns, and increasing uptime.

Lighthouse is transforming how people rent, buy, and sell homes by cutting out the middleman and partnering directly with property suppliers. With a cash back model and flexible options for browsing or working with a specialist, Lighthouse makes the process of finding a home simpler and more rewarding.

Namespace is a purpose-built compute platform designed to accelerate development workflows by significantly reducing build and test times. It integrates seamlessly with tools like GitHub Actions, Docker builds, and Bazel, enabling rapid deployment of ephemeral instances in just a few seconds. Features include built-in Docker image caching, high-performance remote builders, and scalable infrastructure capable of handling numerous concurrent builds. Additionally, Namespace offers end-to-end previews, out-of-the-box observability with metrics and logs, and a private container registry for secure image storage. By optimizing performance and providing cost-effective solutions, Namespace enhances developer productivity and efficiency.

Who we are

Verissimo Ventures is a Pre-seed and Seed Venture Fund based in Israel and the US. We invest primarily in enterprise software companies and take a fundamentals-driven approach to early-stage investing. We work closely with founders to help them build the strongest, most fundamentally sound businesses with potential for explosive growth and a meaningful impact on the market.

We were founded in 2020 and are currently investing out of our $26M Fund 2.